Cash Flow 101 — Savings

If you’re just starting with savings, start here.

Before investing or optimizing, having a simple place to store and organize financial records matters. This helps you see what you actually have, track progress, and avoid losing important information while building basic savings habits.

Smart Saving Strategies

Savings is not about motivation. It is about structure.

Effective saving begins with defined allocation rules, controlled spending, and consistent reserve building. Discipline — not enthusiasm — creates financial stability.

Savings Requires Structure

Stability starts with clarity.

Define measurable goals.

Track cash flow accurately.

Automate reserve allocation.

Small, consistent actions — executed within a system — create long-term resilience.

Savings protects liquidity before growth is pursued.

Cash Flow 101 — Pay Yourself First

A calm, ethical framework for building savings with irregular or variable income

Most books about saving assume your money arrives on schedule.

This one doesn’t.

Cash Flow 101 is not about discipline through denial or forcing habits that don’t fit real life. It’s about understanding how money moves, then placing structure before spending happens—so saving becomes automatic, not exhausting.

This book treats saving as a system design problem, not a willpower test.

What Makes This Different

Unlike most personal finance books, Cash Flow 101:

Does not assume steady paychecks

Does not shame inconsistent income

Does not rely on motivation or guilt

Does not promise shortcuts or outcomes

Instead, it focuses on:

Capture before spending

Structure before behavior

Systems before discipline

You are not asked to “try harder.”

You are shown how to design stability.

What This Book Helps You Do

Understand your true cash flow pattern

Capture income intentionally as it arrives

Build savings without waiting for “extra money”

Reduce stress caused by uneven income

Create stability without rigid rules

No tricks.

No pressure.

No constant monitoring.

Just structure that works with reality.

Who This Is For

This book is for people who:

Earn income irregularly or inconsistently

Struggle to save despite earning enough

Want calm systems instead of financial anxiety

Value ethics, transparency, and autonomy

If saving has always felt impossible—not because you’re careless, but because income timing works against you—this book was written for you.

Part of the 101 Series — A Structured Financial Foundation

• Cash Flow 101 — Pay Yourself First

Build savings by capturing income intentionally from the start

• Spending 101 — Smart Spending

Direct money consciously so it supports your life

• Wealth Basics 101 — Investing, Time & Uncertainty

Understand long-term growth fundamentals

• Taxes 101

Learn how taxes actually work so you can plan clearly

• Future Proofing 101

Prepare for long-term needs with realistic planning

• Stability 101

Create resilience through safeguards and emergency funds

Capture → Direct → Build → Protect → Prepare → Stabilize

Each book stands alone.

Together, they form a complete, ethical financial system.

The Core Principle

Money should support your life — not control it.

This book exists to help make that possible.

Available from Amazon/Kindle or directly from Truality.Finance by Mr.Why

$10.69- “The Total Money Makeover – A Proven Plan for Financial Peace! Follow this updated guide to eliminate debt, master budgeting, and take control of your finances, step by step, toward a stress-free and secure money life."

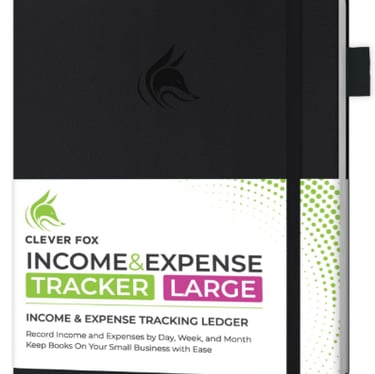

$26.99- “Clever Fox Income & Expense Tracker – Take Charge of Your Business Finances! This A4, 2-year ledger makes bookkeeping simple, helping small business owners track income, expenses, and stay organized—so you can focus on growth, not paperwork."

$20.43“The Index Card – Simple Personal Finance Made Easy! Discover straightforward, actionable tips to manage your money, save smarter, and make confident financial decisions—because personal finance doesn’t have to be complicated.”

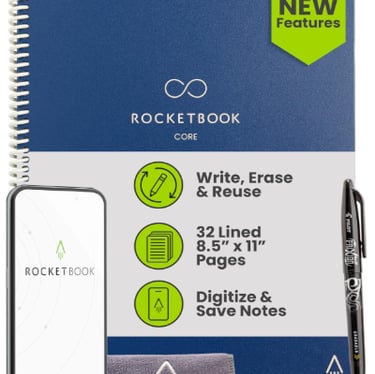

$39.99- “Rocketbook Fusion Reusable Planner – Organize Your Life Without the Waste! Undated and reusable, it combines goal tracking, monthly & weekly calendars, daily to-do lists, and lined/dotted pages—keeping you productive, eco-friendly, and always on top of your plans."

$21.00- “The Simple Path to Wealth – Your Roadmap to Financial Freedom! This guide teaches smart saving, investing, and building wealth step by step, helping you take control of your money and live a richer, freer life.”

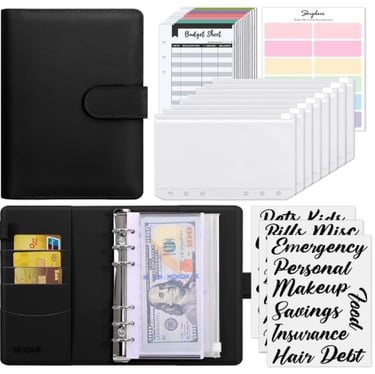

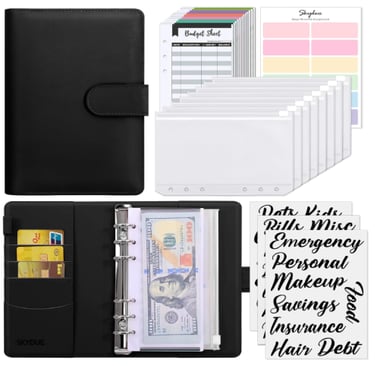

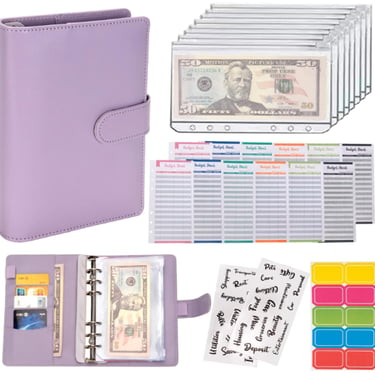

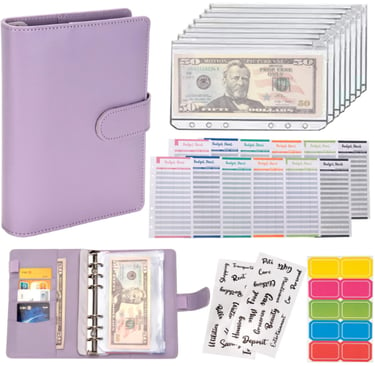

$8.98- “SKYDUE Budget Binder – Your Smart, Stress-Free Way to Save! Includes zipper envelopes, cash pockets, and easy-to-use expense sheets to help you take control of your money, stick to your goals, and make budgeting simple and even a little fun."

“Save Smarter with Mr. Why’s Money-Minded Mondays – Handpicked Amazon Products That Make Every Dollar Count”

“Disclaimer: As an Amazon Associate, Mr. Why’s Money-Minded Mondays earns from qualifying purchases. This helps support the platform at no extra cost to you.”

$12.34- Clever Fox Budget Stickers – A set of bright, helpful stickers designed to make budgeting a little more fun. With plenty of options for monthly and weekly planning, they’re an easy way to highlight goals, reminders, and money tasks in any planner or journal.

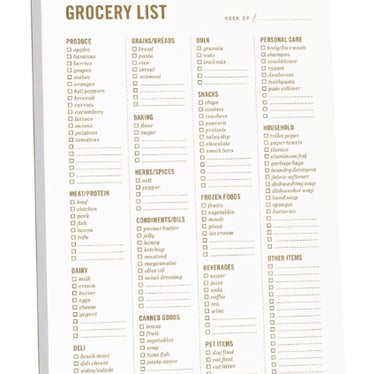

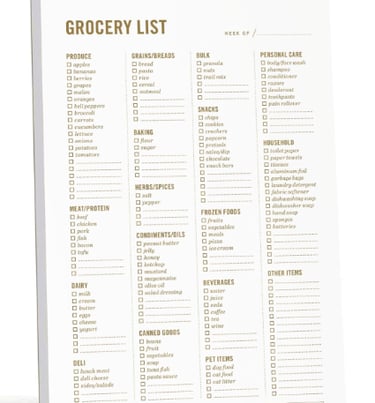

$9.95)- Grocery List Magnet Pad – A 6x9 fridge pad with a clear, categorized layout that makes planning your shopping simple. Just jot things down as you notice them, tear off the sheet when you’re ready, and you’re good to go. Easy, organized, and always right where you need it.

$6.49)- Antner A6 Binder Pockets (12-pack) – Clear, zipper-style pockets that fit perfectly into any A6 binder. They keep cash, receipts, and small documents tidy and protected. Simple, waterproof, and easy to flip through—great for staying organized without any fuss.

$6.98)- NICOOTH Budget Binder (Purple) – A compact A6 binder that helps you sort your cash with zipper envelopes for easy saving and organizing. Simple to carry, simple to use, and a nice way to keep your money plans tidy and clear.

$9.99)- Expandable Coupon Organizer (Black) – A simple, compact organizer that keeps all your coupons in one place. It expands so you can sort everything neatly, making it easier to find what you need when you’re out shopping. Clean, practical, and easy to carry.

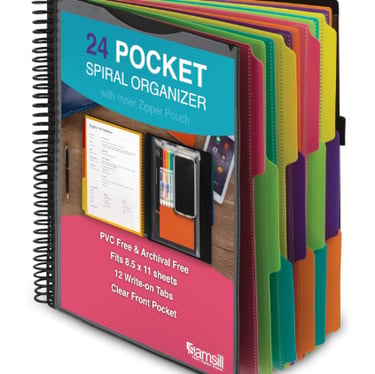

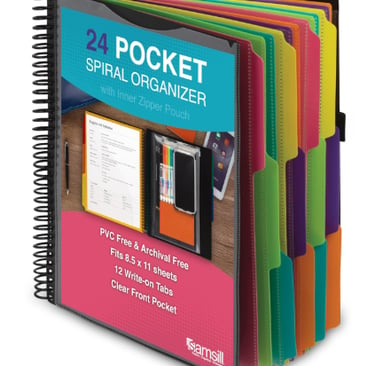

$12.80- Samsill Spiral Folder Organizer – A colorful, easy-to-use organizer with plenty of pockets and dividers to keep papers, notes, and little extras in one place. It’s great for staying on top of things without feeling cluttered, and the zipper pouch helps keep loose items secure.

“Save Smarter with Mr. Why’s Money-Minded Mondays – Handpicked Amazon Products That Make Every Dollar Count”

“Disclaimer: As an Amazon Associate, Mr. Why’s Money-Minded Mondays earns from qualifying purchases. This helps support the platform at no extra cost to you.”

Cash Flow 101: Savings

Savings is the reserve function of your financial system.

Without reserves, every disruption becomes a crisis.

With reserves, decisions remain controlled.

Savings is not about motivation. It is about structure.

01) Pay Yourself First

Allocate savings immediately upon receiving income.

This establishes reserve priority before discretionary spending occurs. Automating this allocation removes reliance on willpower and reduces behavioral leakage.

Savings must be systemized, not emotional.

02) Budget and Spending Control

A structured budget defines limits, not wishes.

Tracking income and expenses reveals friction points and inefficiencies. Categorization tools improve visibility and reduce financial drift.

Clarity prevents instability.

Tools aligned with this strategy are listed below.

03) Starter Emergency Reserve

Begin with a defined liquidity buffer — typically $500–$1,000.

This prevents small disruptions from escalating into debt cycles. The objective is not comfort. It is protection.

Expansion to a 3–6 month reserve follows once cash flow stabilizes.

04) Employer-Sponsored Retirement Contributions

If employer matching is available, capture the full match.

This is structured capital allocation, not speculation. Contribution limits and tax structure should be reviewed annually to ensure alignment.

Growth should occur only after liquidity protection is established.

05) High-Interest Debt Elimination

Debt above reasonable interest thresholds destabilizes savings capacity.

Prioritize structural payoff strategies:

• Debt avalanche (interest-first reduction)

• Debt snowball (liquidity momentum approach)

Eliminating high-interest obligations restores cash flow control.

Savings Implementation Tools

Structure improves when systems support it.

Use a savings calculator to project reserve growth based on:

• Initial allocation

• Monthly contribution

• Interest yield

Projection clarifies timeline and removes ambiguity.

Golden Products: Savings Implementation

Each strategy above connects to structured implementation tools, including:

• Budget tracking systems

• Savings automation tools

• Debt reduction planners

• Structured financial guides

These resources are aligned with the Savings 101 framework and are selected to reinforce disciplined financial systems.

Stability Before Growth

Savings is the foundation of cash flow stability.

Before pursuing investment returns or expansion strategies, ensure:

• Liquidity buffer is established

• High-interest debt is controlled

• Automated savings is configured

• Spending categories are monitored

Growth without reserves increases fragility.

Apply the Structure

If your savings system is inconsistent, reactive, or unclear, begin by strengthening your reserve framework.

Explore the Savings Implementation Tools and structured guides aligned with this page.

Access the Stability Framework → interest.

“Use this savings calculator to estimate how your money can grow over time. Enter your starting amount, monthly contributions, and interest rate to see your future balance and plan smarter.”

Savings

The strategies above represent foundational components of a structured savings system.

Each section connects to carefully selected implementation tools aligned with the topic.

These strategies are not promotional concepts — they are practical financial principles grounded in behavioral discipline and cash flow logic.

Savings Requires Structure

Financial stability begins with measurable planning.

• Define specific savings targets

• Track cash flow accurately

• Automate reserve allocation

• Separate savings from spending

Consistency, not enthusiasm, builds resilience.

Savings protects liquidity before growth is pursued.

Growth without reserves increases fragility.

Implementation Resources

This page provides structured guidance and selected tools aligned with disciplined savings systems. Each resource supports execution — not hype.

Apply the framework. Strengthen reserves. Maintain control.

"The Truality Cause', the brand that is dedicated to integrity, transparency, and delivering accurate, trustworthy content to empower our users."

© 2025. All rights reserved.

"Dedicated to Helping You Build Your Financial Future". Please, feel free to subscribe to our newsletters, updates, and special offers!

2025> please be informed site was AI assisted ⚠️ Content Integrity Protected

🔒 User-Secured Validation

🔒 AI-Assisted Content Notice > Portions of this website's content have been generated or enhanced using artificial intelligence tools. While efforts are made to ensure accuracy and reliability, AI-generated content may contain errors or inaccuracies. Users are encouraged to verify information and consult professionals for advice. [TRUALITY] is committed to transparency and content integrity. Please report to us any concerns.

© 2026 MrWhy Consulting - SaaS

"An Expert In Psychology, Law & Finance!"

“My work is descriptive and analytical — focused on understanding patterns, not prescribing universal solutions.”

The Anti-Shark

“I’m here to Make you money, not take it.”

“I’m here to help, not exploit.”

"Remember to Stay Steady, Stay Real, and Stay You!"