"TRUALITY.FINANCE"

Stabilize Your Cash Flow Before You Try to Grow Wealth.

Run the Cash Flow Stability Check

Most financial advice assumes you’re already stable. Truality helps you understand your real cash flow structure so you stop feeling stuck despite earning income.

If you’re tired of doing everything “right” and still feeling financially unstable, start with the fundamentals of cash flow structure.

→ Start with Cash Flow 101

Why Truality.Finance Exists

Most financial advice assumes stability already exists. It assumes spare income, predictable expenses, and room to recover from mistakes. Real life doesn’t work that way.

Truality.Finance exists to explain the gap between financial theory and financial reality. We break down why common advice fails in practice, how cash flow actually determines stability, and why discipline alone doesn’t automatically create progress.

When cash flow structure is misunderstood, progress stalls — even when income increases.

This work is grounded in ethics, transparency, and systems thinking—not trends, pressure, or persuasion. The goal isn’t to sell certainty. It’s to help you understand what’s actually affecting your stability so you can make decisions with clarity instead of confusion.

The Truality 101 Series — Your Guides with Mr. Why — Now Published on Amazon/Kindle

The 101 Series is a collection of short, foundational books designed to explain how money systems actually work—without hype or unrealistic promises.

Each book focuses on one core area:

cash flow, spending, investing, taxes, stability, and long-term planning.

These are not shortcut manuals.

They are structured explanations of:

• how financial systems are built

• why stress and confusion are common

• how behavior, time, and uncertainty shape outcomes

• and why stability must come before growth

Every book stands on its own.

There is no required order.

The goal is clarity—so financial decisions feel steadier, less reactive, and more grounded in reality.

Amplified Income™ — The Truality Definition of Smart Money Thinking

Amplified Income™ is Truality’s framework for handling extra money with intention instead of impulse.

Why Amplified Income™ Matters

Most people don’t grow extra money — they burn it.

They get a bonus, settlement, tax return, or payout and:

• spend it fast

• pay bills that stack right back up

• chase impulses

• end up with nothing to show for it

The problem isn’t the money — it’s the behavior.

Amplified Income™ turns a portion of unexpected income into long-term progress instead of short-term relief.

Spend a little.

Save a little.

Amplify the rest.

Learn to save, spend smart, invest, and secure your financial future effectively.

Welcome to TRUALITY.FINANCE

Tools Built for Financial Stability

Each finance section includes a free, theme-based calculator designed to help you understand how money flows in real life — not just in theory.

Real-time market data is available for reference, but stability comes first.

Imagine a financial structure that supports your life instead of stressing it. TRUALITY.FINANCE helps you understand your cash flow, reduce reactive decisions, and build confidence through clarity—not pressure. From foundational concepts to practical tools, everything here is designed to strengthen stability before pursuing growth.

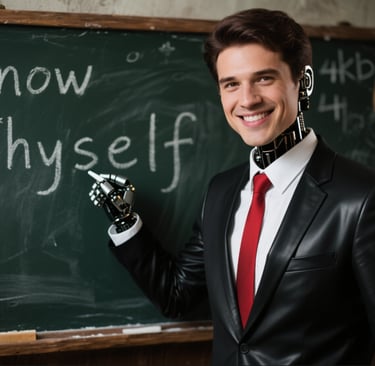

Financial Stability Through Clarity

At Truality.Finance, Mr. Why explains how saving, spending, investing, and taxes function within real-world cash flow systems—so decisions are grounded in structure, not pressure.

The focus is not optimization or shortcuts, but understanding how money behaves over time in an unpredictable economy.

Clear structure leads to steadier decisions.

Steadier decisions support long-term stability.

What Can You Expect?

Truality.Finance is built for individuals who want to understand how money actually behaves before attempting growth.

Cash Flow Foundations

Learn how income, expenses, timing, and structure determine stability long before investing begins.Spending Awareness

Understand how everyday decisions shape long-term outcomes — beyond simple budgeting rules.Debt and Stability

See how debt interacts with cash flow structure and why repayment plans fail when stability is ignored.Saving with Structure

Move beyond goals and understand how savings function within your financial system.Structured Financial Resources

Access calculators, breakdowns, and books designed to clarify systems — not sell tactics.

Build Stability Before You Pursue Growth

Financial progress doesn’t start with ambition.

It starts with structure.

Begin with the fundamentals, understand your cash flow clearly, and move forward with steadier decisions.

Start where stability begins.

"The Truality Cause', the brand that is dedicated to integrity, transparency, and delivering accurate, trustworthy content to empower our users."

© 2025. All rights reserved.

"Dedicated to Helping You Build Your Financial Future". Please, feel free to subscribe to our newsletters, updates, and special offers!

2025> please be informed site was AI assisted ⚠️ Content Integrity Protected

🔒 User-Secured Validation

🔒 AI-Assisted Content Notice > Portions of this website's content have been generated or enhanced using artificial intelligence tools. While efforts are made to ensure accuracy and reliability, AI-generated content may contain errors or inaccuracies. Users are encouraged to verify information and consult professionals for advice. [TRUALITY] is committed to transparency and content integrity. Please report to us any concerns.

© 2026 MrWhy Consulting - SaaS

"An Expert In Psychology, Law & Finance!"

“My work is descriptive and analytical — focused on understanding patterns, not prescribing universal solutions.”

The Anti-Shark

“I’m here to Make you money, not take it.”

“I’m here to help, not exploit.”

"Remember to Stay Steady, Stay Real, and Stay You!"